Annual Escrow Analysis

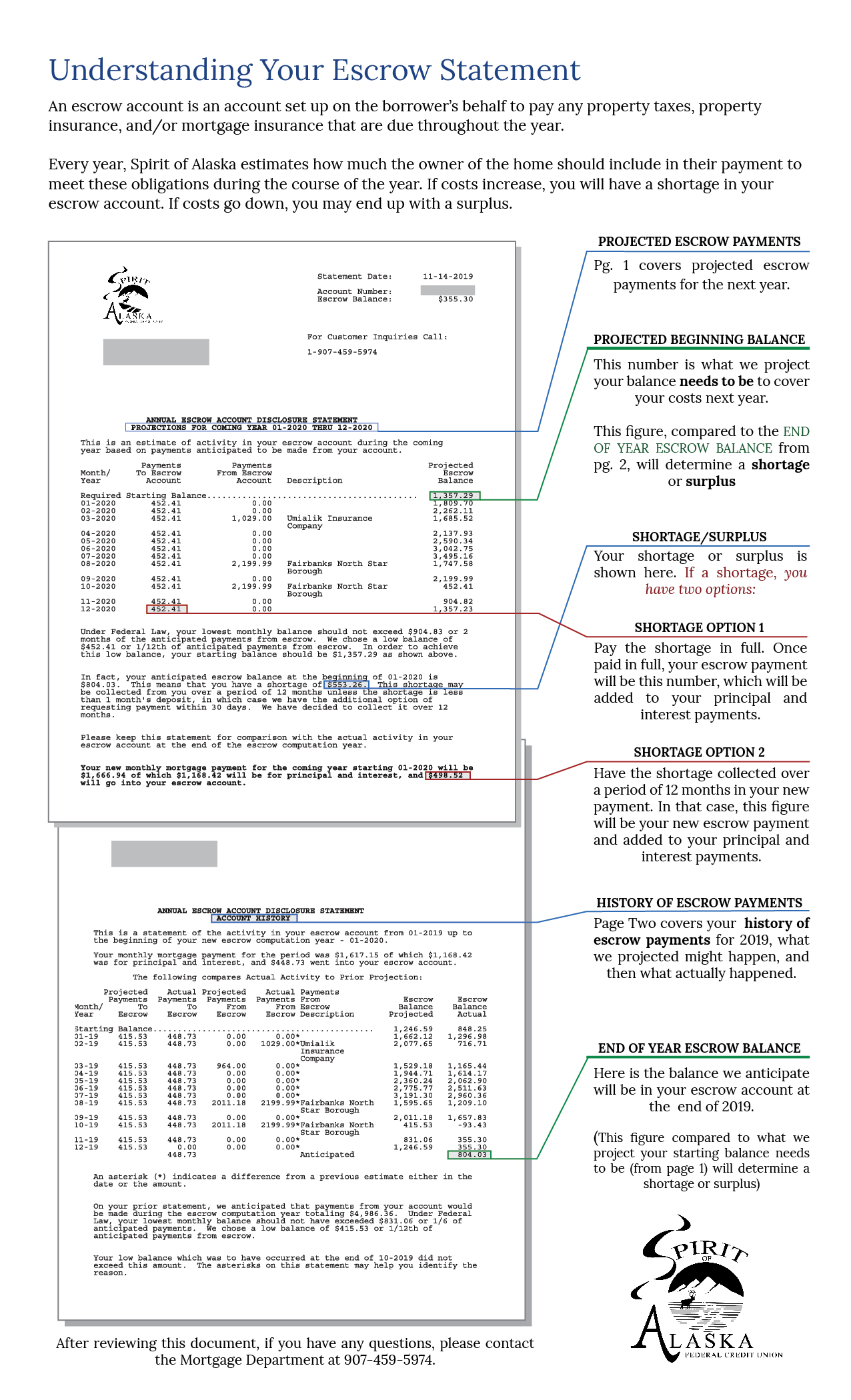

In this blog post, our goal is to clear up some of the common questions surrounding the escrow analysis of your loan/account that we perform on an annual basis. Let’s start by defining a few key terms. For a visual explanation, scroll down for a helpful infographic.

What is an escrow account?

An escrow account is an account set up on the borrower’s behalf to pay any property taxes, property insurance, and/or mortgage insurance that are due throughout the year. Every year, Spirit of Alaska estimates how much the owner of the home should include in their payment to meet these obligations during the course of the year.

Why do you need to do an escrow analysis?

The goals of this analysis is to ensure your monthly escrow payments accurately reflect the amount of money needed to pay the taxes and insurance associated with your loan/account.

Why does my payment change every year?

Property taxes and homeowner’s insurance amounts fluctuate every year. Escrow payments are adjusted as a surplus or a shortage to address these changes. This could be an increase or decrease from the previous year.

What happens with an escrow surplus?

If you have a surplus of less than $50:

You will not be required to do anything. The surplus will be carried over to next year and included in the projected analysis.

If you have a surplus of greater than $50:

A check will be mailed to you with your escrow analysis statement.

What happens with an escrow shortage?

If you have a shortage of less than $50:

You will not be required to do anything. The shortage will be carried over to next year and included in the projected analysis.

For escrow shortages greater than $50: You have two options.

Option 1 – Pay a larger payment. The shortage is automatically calculated to be paid back over 12 months in the analysis.

Option 2 – Pay the shortage in full. The account can be reanalyzed to include the new, higher escrow balance, and lower the amount of your monthly payment.

We invite anyone with questions relative to their analysis or their future payments to call the mortgage lending department at 907 459-5974 during regular business hours. Thank you for choosing Spirit of Alaska Federal Credit Union.

Download Printable Escrow Statement Infographic